Trade Set-Up (Global Cues & Context): Global sentiment remains cautious but stable. Major international indices are trading in a tight range with no significant overnight shock, suggesting a neutral to slightly positive start for Indian markets.

Institutional flows remain a headwind. FIIs continue to create a ceiling at higher levels, with every market bounce witnessing supply from large players.

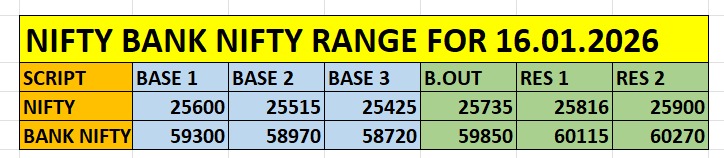

Key intraday levels for Nifty and Bank Nifty based on price structure and options positioning.

Option Chain Analysis:

NIFTY

PCR (Put-Call Ratio) currently at 0.68, indicating oversold territory

Despite bearish sentiment, this also opens the possibility of a short-covering rally if support holds

Heavy Call Writing observed at 25800 & 26000 – these act as strong resistance zones

Support (Put Writing):

Major Put OI built at 25600 & 25500

As long as 25600 holds, bears may not get free movement

BANK NIFTY

Aggressive Call writing compared to Nifty

60000 remains the major resistance

59500 strike is the key battleground with heavy OI on both sides

Sustaining above 59500 for 30 minutes could trigger a quick move towards 59850

Support:

Strong support near 59000

Breakdown below this level may extend the fall towards 58700

Final Outlook for Today

The market is expected to remain range-bound with a negative bias.

Morning session may stay choppy and directionless, with the real move likely in the second half as news flow and results kick in.

With Reliance (RIL) results due today, expect nervous and sideways action until clarity emerges.

Trading approach:

✔ Buy only near strong supports

✔ Sell on resistance

✔ Low-risk, low-quantity trades preferred

“Sometimes no trade is a good trade.” Amit Khandelwal.

Disclaimer: The views shared above are for educational and informational purposes only. We are not a SEBI-registered Research Analyst or Investment Advisor. This content does not constitute investment advice or a recommendation to buy or sell any security. Market conditions may change rapidly. Readers are solely responsible for their trading decisions and should perform their own due diligence or consult a certified financial professional before taking any action.