Trade Setup: Global cues remain mixed to positive. US markets (Dow Jones & S&P 500) closed at record highs overnight. However, underlying caution persists due to fresh investigations by the Trump administration into the US Federal Reserve and potential Iran-related tariff developments.

FIIs continue to remain net sellers, keeping the sell-on-rise mindset active, even if markets open on a positive note.

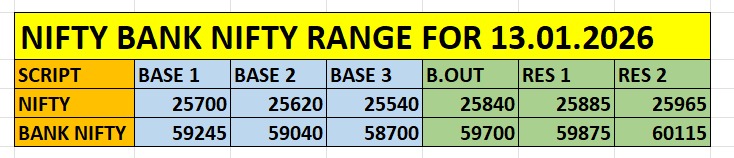

Nifty & Bank Nifty trading ranges indicate immediate support–resistance zones for the session.

Options Data Analysis (Weekly Expiry Day):

NIFTY:

Massive Call writing at 26000, acting as a strong resistance

Active Put writing at 25700, indicating near-term support

BANK NIFTY:

Heavy resistance visible near 60000

Support base shifting higher towards 59200–59400

Market Recap & Structure:

Yesterday’s session was a classic “roller-coaster”, testing both bulls and bears.

Markets opened under heavy pressure:

Nifty plunged nearly 200 points, hitting an intraday low of 25473

India VIX spiked over 6%, signaling heightened fear

As discussed earlier, PCR readings suggested the market was in oversold territory. Mid-day sentiment flipped sharply:

Sensex recovered 1000+ points

Nifty bounced back to close near 25800

Positive commentary from US Ambassador Sergio Gor acted as a key sentiment booster.

Technical Outlook:

The long lower shadow on the daily chart (bullish hammer-like formation) confirms 25500–25450 as a strong demand zone.

Market Strategy:

Buy on dips near major supports

Sell on resistance levels

Overall structure suggests a consolidation phase

Disclaimer: The views shared above are for educational and informational purposes only. We are not a SEBI-registered Research Analyst or Investment Advisor. This content does not constitute investment advice or a recommendation to buy or sell any security. Market conditions may change rapidly. You are solely responsible for your trading decisions. Always perform your own due diligence or consult a certified financial planner before executing any trade.