Trade Set-Up: The global backdrop remains shaky. A strengthening US Dollar Index (DXY) is weighing on emerging markets like India. US markets closed in the red overnight (Dow down ~0.8%, S&P 500 down ~0.2%).

US Treasury yields are rising, prompting FIIs to pull money from risk assets. While Asian markets are largely flat, India VIX is creeping higher — signaling rising caution. This is not a “buy the dip” market, but one where capital protection is key.

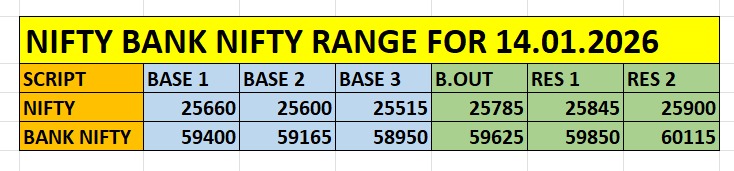

Key intraday levels: Nifty & Bank Nifty.

Options & Data Analysis:

NIFTY:

Massive Call writing seen at 25800–25900, acting as immediate resistance

Put support remains thin below 25600

If 25600 breaks, next major support lies near 25450

BANK NIFTY:

Heavy resistance placed near 60000

Support band shifting higher towards 59400–59200

One Big Watch-Out:

Today is Infosys Q3 results day, which could dictate IT sector momentum and influence Nifty’s second-half direction.

Market Structure View:

The market remains in a sell-on-rise / consolidate phase. Strength should be used to lighten positions near resistance, while aggressive longs should be avoided.

Disclaimer: The views shared above are for educational and informational purposes only. We are not a SEBI-registered Research Analyst or Investment Advisor. This content does not constitute investment advice or a recommendation to buy or sell any security. Market conditions may change rapidly. You are solely responsible for your trading decisions. Always perform your own due diligence or consult a certified financial planner before executing any trade.