Trade Set-Up (Global Sentiment Cautious): Global sentiment remains subdued, with investors adopting a defensive stance amid multiple macro headwinds.

US Markets: Wall Street is showing signs of exhaustion as investors await upcoming inflation data. Momentum from the Trump Trade has cooled, keeping risk appetite in check.

GIFT Nifty: Indicates a flat to slightly negative start, suggesting a cautious opening for Indian markets.

Bond Yields & Flows: The US 10-year Treasury yields remain firm, putting pressure on emerging markets. FIIs continue to remain net sellers, selling over ₹3,200 Cr yesterday, creating a ceiling on every market rally.

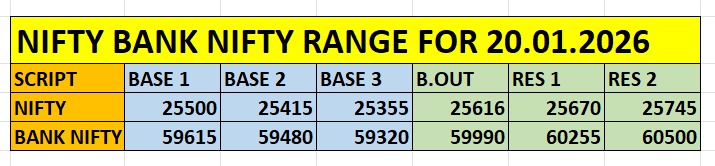

Key intraday trading levels for Nifty and Bank Nifty based on options positioning.

Options Data – Pressure Zone

NIFTY

Massive Call Writing visible at 25600 & 25700, indicating strong overhead resistance

Immediate support placed near 25500

Index is trading below short-term moving averages

Daily chart shows a Lower High – Lower Low structure, a classic bearish signal

Overall, momentum remains weak unless Nifty reclaims key resistance zones.

BANK NIFTY

Showing relatively better strength compared to Nifty

Hovering near the 60000 mark

As long as Bank Nifty holds above 59500, chances of recovery remain open

Final Outlook for Today

The market is expected to remain range-bound between 25450 and 25650 for Nifty. Focus should be on capital protection rather than aggressive profit-hunting.

Trading approach:

Buy only near strong supports

Sell on resistance

Avoid over-trading in low-momentum conditions

Disclaimer: We are not a SEBI-registered Research Analyst or Investment Advisor. You are solely responsible for your trading decisions. Always perform your own due diligence or consult a certified financial planner before executing any trade.