Trade Set-Up: Global Cues (Bearish Undertone)

Global markets are showing early signs of exhaustion, with risk appetite turning cautious.

US markets closed in the red on Friday, led by profit booking in the technology sector.

Asian markets are trading lower this morning, with weakness visible across major indices including Nikkei and Hang Seng.

GIFT Nifty indicates a gap-down opening of around 60–80 points, suggesting that domestic markets may begin the session on a defensive note.

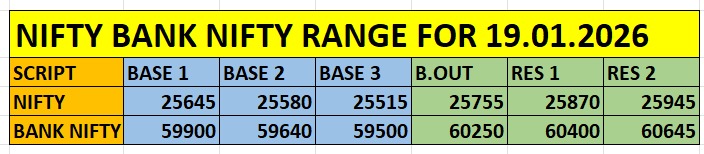

Key intraday trading levels for Nifty and Bank Nifty based on options positioning.

Options Data – The Pressure Zone

NIFTY

Massive Call writing has shifted lower to 25800 & 25900, creating a strong overhead resistance zone

Immediate support is placed near 25500

Put writers are unwinding positions, reflecting weakening confidence at lower levels

On the daily chart, Nifty has formed a Lower High – Lower Low structure and has already traded below the 20-period SMA, which often triggers momentum-based selling.

A decisive 15-minute close below 25480 could open the door for a deeper correction towards 25200.

BANK NIFTY

Bank Nifty continues to trade above its 20-period SMA, indicating relative strength versus Nifty

Stable bond yields and PSU bank strength (post Q3 results) are providing support

As long as Bank Nifty holds the 59500–59700 zone, the near-term bias remains positive, despite broader market pressure.

Disclaimer: We are not a SEBI-registered Research Analyst or Investment Advisor. You are solely responsible for your trading decisions. Always perform your own due diligence or consult a certified financial planner before executing any trade.